According to the United States Department of Agriculture (USDA), food products and agricultural commodities have been among the highest-valued exports since 2013. It’s estimated that in 2020, food exports climbed to more than $140 billion.

While the USDA report includes a diverse array of fresh, prepared, and packaged products, all of the products reflect a common trend: continued growth in global demand. With all this growth, companies that export goods are looking for ways to reduce taxable income.

To accomplish this reduction in taxable income, companies can create interest charge domestic international sales corporations (IC-DISC).

The following will be covered in our article:

- What Is an IC-DISC?

- Who Can Benefit from Forming an IC-DISC?

- How Can an IC-DISC Reduce an Export Company’s Taxable Income?

- How Does an IC-DISC Function?

- Is an IC-DISC Allowed to Have Foreign Shareholders?

- How Is an IC-DISC Taxed?

- How to Execute an IC-DISC

- Calculate Your IC-DISC Tax Savings

- Calculating IC-DISC Commissions

- Use of IC-DISCs by Cooperatives

- Factor Accounts Receivable Through an IC-DISC

- IC-DISC Transaction by Transaction Method

What Is an IC-DISC?

An interest charge domestic-international sales corporation (IC-DISC) is a US domestic corporation that meets certain requirements under US tax law and has made a valid IC-DISC election.

The IC-DISC incentive is available to almost any US taxpayer—individuals, C Corporations, S Corporations, partnerships, or LLCs—as long as they have qualifying exports.

A taxpayer who has established an IC-DISC annually identifies their qualifying exports and calculates a commission payment to the IC-DISC. Taxpayers have flexibility to choose the commission payment calculation method that provides the highest tax savings.

Who Can Benefit from Forming an IC-DISC?

Taxpayers need to consider the following steps for the IC-DISC incentive:

- Determine if they have products that are qualifying exports—generally 50% or greater US manufactured or produced goods or services.

- Review historical financial information, and prepare an estimate of the tax benefit.

- Organize a US corporation that meets the formal legal requirements for an IC-DISC election.

- On an annual basis, calculate the qualifying commission payment to the IC-DISC.

When calculating the potential cash-savings, taxpayers should also consider the legal and maintenance costs of an IC-DISC.

How Can an IC-DISC Reduce an Export Company’s Taxable Income?

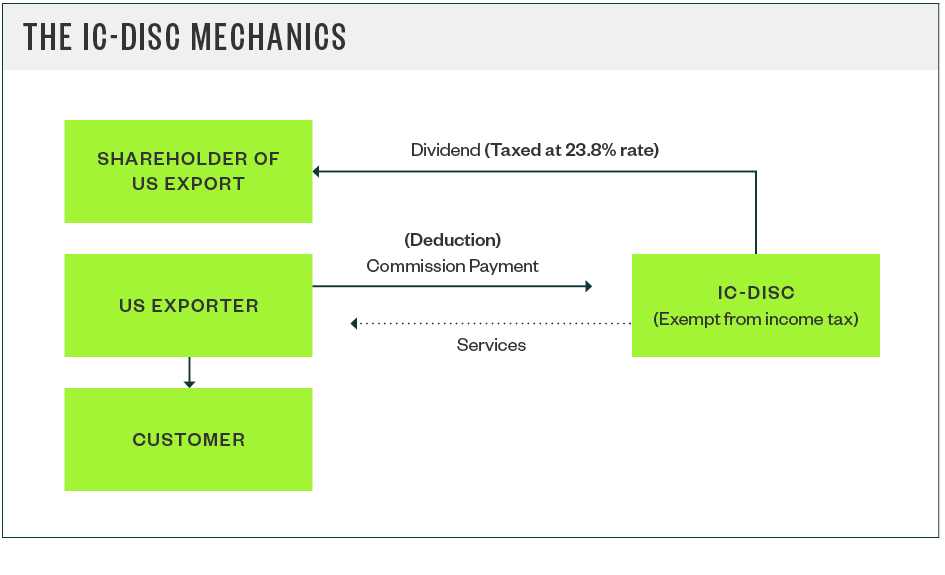

With this strategy, the exporter—an S corporation, LLC, partnership, or closely held C corporation—pays commissions to the IC-DISC, which is owned by the exporter’s shareholders or partners. The commissions are deductible by the exporter for US federal income tax purposes, and the IC-DISC is treated as a federally exempt entity.

Tax reform in 2017, referred to as The Tax Cuts and Jobs Act (TCJA), made significant changes to the US tax system; however, an IC-DISC can still provide tax benefits to US companies that export goods.

The top income tax rate on qualified dividends for individuals, including the net investment income tax, is currently 23.8%. For ordinary income, however, the top tax rate is 37%—not including an individual’s potential Medicare surtax or net investment income tax liability. This means a maximum of 13.2% rate differential still exists. In addition, there may be additional considerations at the state tax level. In addition to the tax rate difference, there are opportunities to defer taxable income into future periods and create additional operating cash flow and time value of money savings.

Unlike many tax-planning strategies that result in deferred tax payments, an IC-DISC can provide both deferred tax savings and a permanent tax benefit to the extent of the spread between the shareholders’ top marginal tax rates and the qualified dividend tax rates.

How Does an IC-DISC Function?

Ownership and Organizational Structure

In a departure from the usual substance-over-form approach to income tax law, an IC-DISC is, by design, form over substance. An IC-DISC doesn’t need employees or office space, and it doesn’t have to perform any services or participate in sales to earn a commission.

However, the entity is required to maintain a separate set of books and records, including a separate bank account. It must have only one class of stock, and it must, at all times, have stock outstanding with a par or stated value of at least $2,500.

It's also important to take into account the foreign-derived intangible income (FDII) deduction for C corporations that was included under the TCJA. The FDII deduction may apply to a profitable C corporation with export sales, especially if foreign margins are high and fixed assets are low.

It’s worth noting that the shareholders of the IC-DISC don’t need to be the same as the shareholders of the exporting company. An IC-DISC can be used to provide a benefit to key employees or as a tool in estate and succession planning. Consult with your tax advisor regarding the issues and risks involved with these arrangements before using an IC-DISC for any of these purposes.

Is an IC-DISC Allowed to Have Foreign Shareholders?

An IC-DISC may have foreign shareholders. For these foreign owners, any distribution—actual or deemed—is income effectively connected with a US-permanent establishment.

The dividends paid from an IC-DISC to its shareholders are considered to be foreign-source income. This makes the use of an IC-DISC particularly valuable to US shareholders with passive foreign tax credit carryovers.

How Is an IC-DISC Taxed?

An IC-DISC is categorized as a domestic C corporation that’s tax-exempt for federal income tax purposes.

How to Execute an IC-DISC

If the corporation elects to be treated as an IC-DISC moving forward, the election must be made within 90 days before the beginning of the first taxable year of the IC-DISC. It must then be signed by all shareholders as of the effective date of the election.

Once made, the election is effective for all subsequent years until it’s revoked by the corporation.

Calculate Your IC-DISC Tax Savings

Based on foreign sales of products manufactured, produced, grown, or extracted in the United States, the exporter pays a commission to the IC-DISC and then deducts the commission from its ordinary business income. This results in a deduction at ordinary tax rates. The IC-DISC then receives the commission without having to pay federal tax on the income.

In most cases, the IC-DISC distributes this cash as a dividend to its shareholders. As long as the shareholders are individuals or pass-through entities, such as partnerships or S corporations owned by individuals, the dividend is taxed at the favorable qualified dividend tax rates.

Example

An S-corporation hops grower has domestic gross receipts of $25 million and foreign gross receipts of $15 million for a total of $40 million. The cost of growing, harvesting, drying, and bailing the hops—which will be sold both domestically and overseas—leaves the gross margin at $8 million. After general expenses, the grower’s net taxable income is $3.75 million domestically and $2 million internationally.

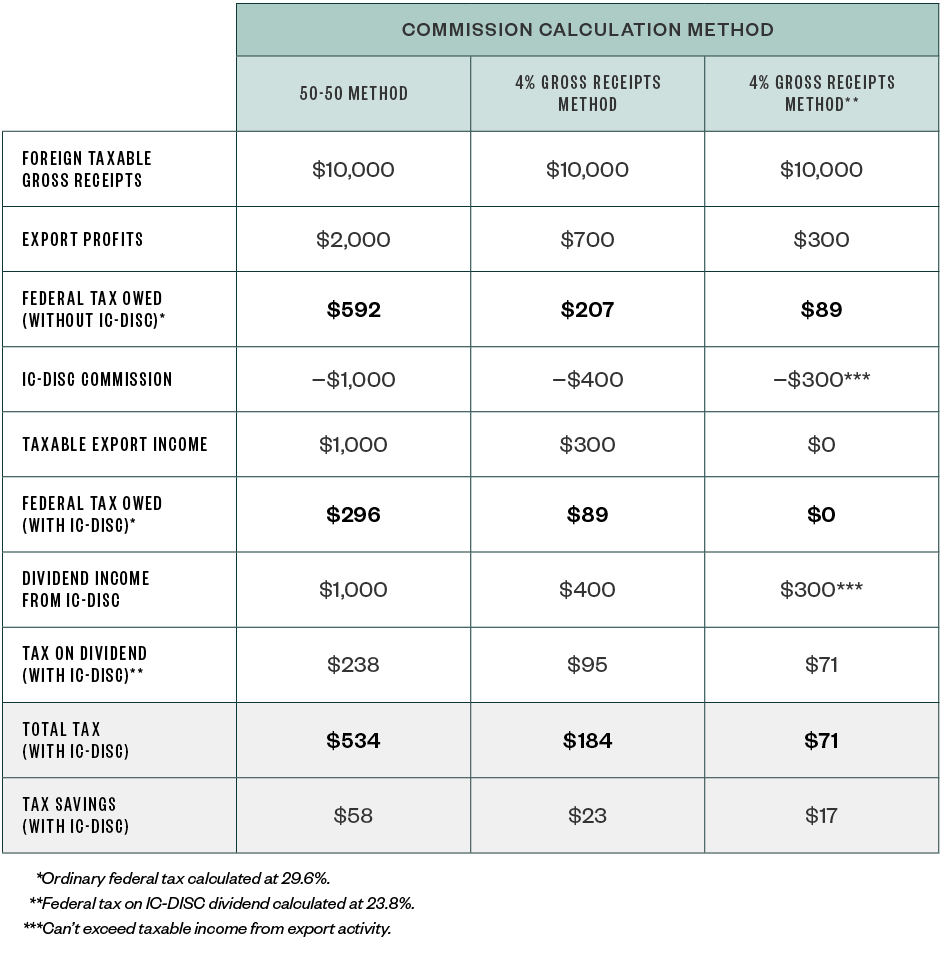

To determine the permanent federal tax savings using an IC-DISC, start by calculating its commission, which in this case can be either of the following:

- 50% of export net income

- 4% of export gross receipts, limited to export net income

In this example, the first method provides a commission of $1 million—50% of $2 million, the grower’s net taxable international income. The second gives us a commission of $600,000—4% of $15 million. In general, you’ll want to choose the larger of the two amounts for the greatest tax benefit. In this case, you’d choose the first, which results in a $1 million commission paid by the grower to the IC-DISC.

As a result of this commission, the grower’s taxable income is reduced by $1 million. Since the grower is an S corporation, its shareholders report this income on their individual income tax returns. Assuming the shareholders are in the top tax bracket—and taxed at 29.6%, which is the top rate of 37% multiplied by 80% for the qualified business income (QBI) deduction—the commission payout results in a federal tax reduction of $296,000 for the shareholders.

The $1 million paid to the IC-DISC is taxed to the IC-DISC’s owners, when paid or deemed paid, as a qualified dividend at the 23.8% rate resulting in tax of $238,000. The difference between the ordinary income tax saved by the individual shareholders and the new qualified dividend tax liability incurred by the IC-DISC results is a tax savings of $58,000.

Exceptions

The IC-DISC could also choose not to pay a dividend to its shareholders. In this case, an interest charge would apply to the deferred tax, hence the entity’s name. The interest charges are based on US Treasury bill rates.

There are also deemed distribution rules related to qualified export receipts that exceed $10 million. These rules can result in shareholders being taxed on the IC-DISC’s earnings without there being an actual distribution.

Calculating IC-DISC Commissions

Several methods may be used to calculate the amount of commission the IC-DISC may receive, including the following:

- 4% of its qualified export receipts subject to export profit limitations

- 50% of its combined taxable income or export profits

- The actual amount earned by a buy-sell IC-DISC that has its own employees and operations

The table below demonstrates how using different methods to calculate the IC-DISC’s commission can have varying tax outcomes.

Use of IC-DISCs by Cooperatives

Many cooperatives export their patrons’ products overseas. Cooperatives can make use of an IC-DISC by creating a sibling entity owned by a pass-through entity—such as a partnership or trust—that’s owned by the same members as the exporting cooperative.

The dividend is paid to the pass-through entity and ultimately to the members. Cooperatives should consult with their tax advisors before setting up an IC-DISC due to the complexity in determining a cooperative’s taxable income.

Factor Accounts Receivable Through an IC-DISC

Factoring accounts receivable (AR) through an IC-DISC often results in additional tax savings. It allows a company to increase its qualified export revenue and, as a result, the income it can ultimately pay out as dividends.

Under the tax code, qualified export revenue includes interest on any obligation that’s a qualified export asset. Income earned through a factoring arrangement is treated as interest, and qualified export assets include AR that results from a qualified export sale.

When an exporter and its IC-DISC enter an AR-factoring agreement, the exporter sells its AR at a discount to the IC-DISC. The IC-DISC recognizes the discount as interest income, and the exporter is then able to deduct the loss that results from the sale of its AR.

As a result, the AR-factoring agreement increases the IC-DISC’s qualified export revenue, which isn’t subject to federal tax, and reduces the income of the exporter. This strategy provides savings on the tax-rate difference between the ordinary deduction for the exporter and the qualified dividend income eventually paid out through the IC-DISC.

Depending on the level of export sales, AR-factoring can create a substantial tax deferral, especially in the first year of the AR-factoring agreement or if the operating company’s AR continues to grow.

Another important fact is that the tax deferral in AR-factoring is largely dependent on the operating company being an accrual basis taxpayer, as opposed to cash.

The IRS agrees with the classification of these transactions, and the above positions are supported through a revenue ruling. In such an arrangement, transfer pricing supporting the discount rate is essential and should be reviewed periodically.

For more information on this method, please see Boost the Benefits of an IC-DISC with Accounts Receivable Factoring.

IC-DISC Transaction by Transaction Method

Depending on the nature of a business and variability of product lines, it could increase its tax savings by reviewing each transaction through a series of computations to determine the transactional data.

The data is run through a series of algorithms that determine the maximum allowable commission, calculate the allowable calculation combinations, and select the greater option. By looking at each transaction separately, the results may yield a higher commission than what was originally calculated.

This could even result in favorable tax savings during years where profits are down, unlike basic IC-DISC commission methods.

We’re Here to Help

When used effectively, IC-DISCs could create significant tax-savings opportunities and additional operating cash flow. The tax savings could be an effective tax deferral strategy and become permanent.

To learn more about how to implement an IC-DISC, quantify potential annual tax savings, or explore advanced planning opportunities—such as AR factoring or IC-DISC transactional analysis —contact your Moss Adams professional.